The Current State of Digital Mortgage Adoption [Infographic]

When it comes to the mortgage process, it would seem that the tides are shifting as more and more lenders turn to digital mortgage technology to empower borrowers with a superior mortgage experience. Maxwell recently teamed up with HousingWire to conduct a survey of mortgage lenders to get a feel for the current state of digital mortgage adoption in the industry.

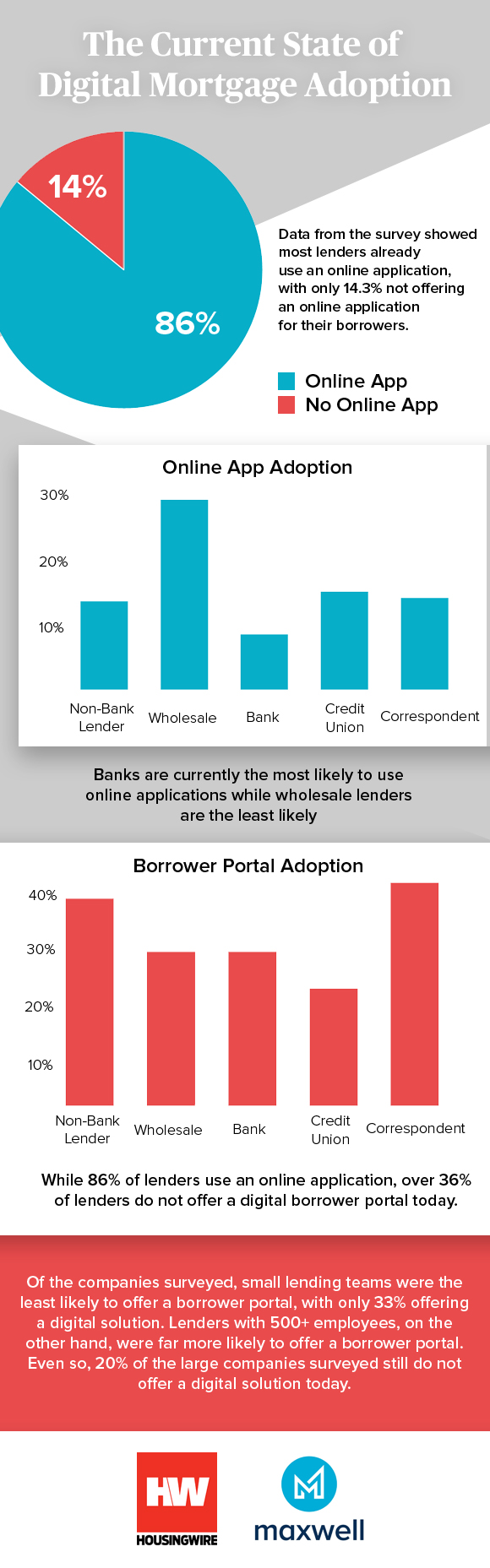

Survey says: digital mortgage adoption rates are climbing, especially for larger lenders. The majority of lenders surveyed, regardless of size, now use an online application at the very least, with 86% of respondents reporting that they offer a digital loan application to borrowers.

With that said, a smaller portion of respondents offered a borrower portal for homebuyers, with only 64% of respondents reporting that they offered a digital portal to help manage the borrower experience.

The uptick in digital mortgage adoption is no surprise; it reflects a growing need for efficiency on the lender side and increasing demand for a superior user experience on the borrower side.

According to PwC’s 2018 Home Lending Experience Report, 58% of borrowers expect their lenders to close their mortgage loan in less than 30 days.

At Maxwell, the lenders using our platform close loans 45% faster than the national average and utilize features like digital document pulls, chat and messaging, automated realtor notifications, and bank-grade security to keep the loan process moving while providing a sleek, minimalist portal for borrowers to ensure that everyone is happy.

A digital mortgage solution like Maxwell means more efficient lenders, happier borrowers, and better profit margins. With that in mind, it’s really no surprise that digital mortgage adoption rates show no sign of slowing down anytime soon.

Check out the infographic below for more on the current state of digital mortgage adoption:

For more about how digital mortgage technology can positively impact borrower satisfaction and lender profitability, read our complimentary eBook, “Borrower Satisfaction & Profitability.”