Tennessee leads the nation in net borrower migration: Uncover essential insights for mortgage lenders

In this exclusive report we use Maxwell Business Intelligence data to unpack migration trends in the state of Tennessee. With the 4th highest growth compared to any other state, Tennessee provides opportunities for mortgage lenders to consider as they look to grow their mortgage footprints.

Tennessee takes the #4 spot in highest inbound migration across the US

In this report, you’ll discover how to reach borrowers migrating to Tennessee with our exclusive insights, including:

- Tennessee’s growth compared to other states

- The top states people are migrating from

- Hotspots where people in Tennessee are settling, including city – and county-specific data

Tennessee’s growth compared to other states

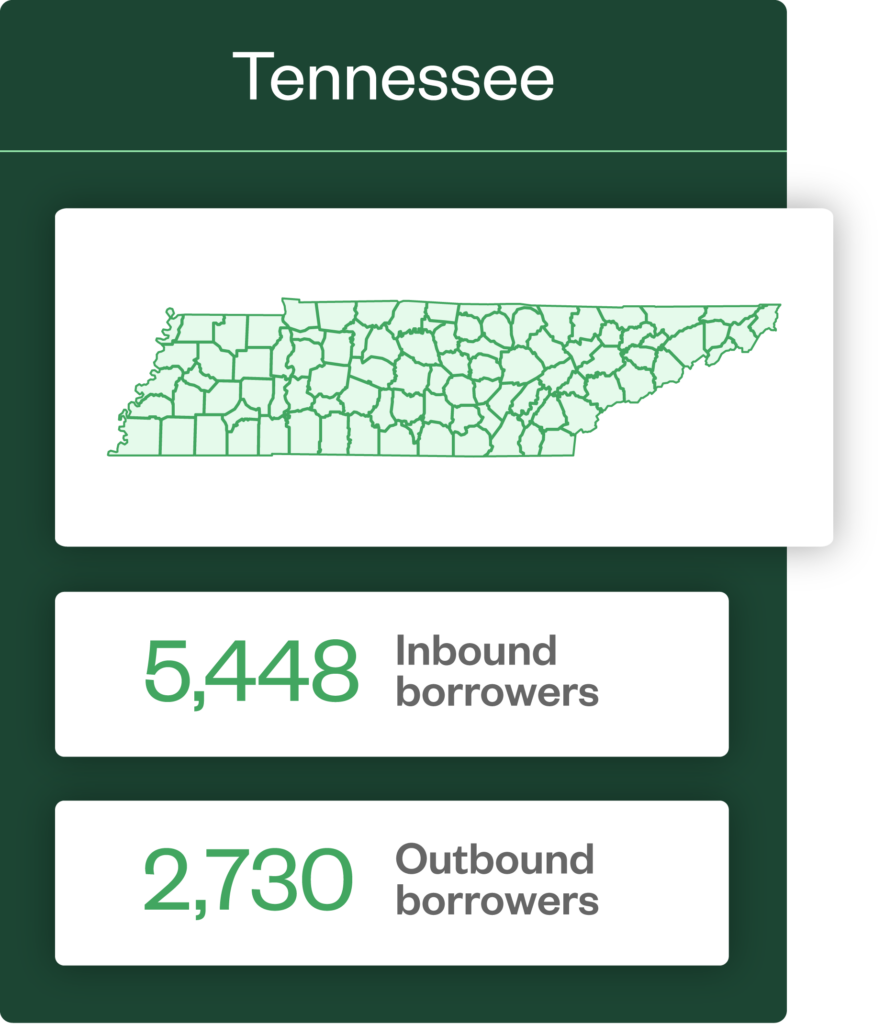

The trends presented in this report are derived from borrower migration data. The map above illustrates the net growth or decline each U.S. state has experienced due to borrower migration since 2021. The figures are calculated by subtracting the total number of outbound borrowers (those moving out of the state) from the total number of inbound borrowers (those moving into the state), then dividing by each state’s 2023 U.S. Census population. These trends indicate which states are attracting more borrowers than they’re losing, highlighting growth potential and opportunities for lenders to expand their footprints in these regions.

With over 5,400 borrowers moving to Tennessee from another state and over 2,700 borrowers moving out of Tennessee since 2021, Tennessee exhibits the fourth-highest migration growth per capita of any state according to Maxwell Business Intelligence data.

The rising number of borrowers moving to Tennessee highlights the state’s increasing appeal, creating a significant opportunity for local banks, credit unions, and mortgage banks to expand their customer base.

While Montana, Hawaii, and Arizona lead the nation, Tennessee ranks fourth in attracting borrowers from across the country. This influx presents a unique chance for mortgage lenders to connect with new residents and meet the needs of those moving within the state.

To maximize this opportunity, mortgage lenders should understand where these new residents are moving from and tailor their services accordingly. As mortgage lenders seek to connect with buyers relocating to Tenessee, it’s crucial to understand their states of origin.

Migration by state:

The top 5 states residents are relocating to Tennessee from

California is the primary source of new residents moving to Tennessee, with 839 borrowers relocating from California to Tennessee. Following closely behind, Washington contributes 168 borrowers. Oregon, Colorado, and Texas also play notable roles.

You can hover of the map on this page to explore the other states nationwide where borrowers moved from to Tennessee since 2021, according to Maxwell mortgage lender data.

These figures underscore the diverse origins of individuals and families choosing Tennessee as their new home. Understanding these migration patterns can help lenders target and attract new borrowers from these key states more effectively.

Mapping Tennessee’s migration: Where borrowers choose to settle

Maxwell’s data reveals the most popular cities and counties where new borrowers are choosing to establish their homes in Tennessee.

Top cities for inbound borrowers:

- Nashville

- Memphis

- Murfreesboro

- Clarksville

- Franklin

Leading counties for inbound borrowers:

- Davidson

- Williamson

- Rutherford

- Wilson

- Maury

As a mortgage lender in Tennessee, understanding where new borrowers are settling allows you to tailor your marketing and outreach efforts more effectively. By focusing on the top cities and counties for inbound borrowers, you can develop targeted strategies to connect with potential clients seeking out these high-demand areas.

Charting the course forward

Don’t miss out on the chance to grow your mortgage business in Tennessee. With the right insights and strategies, you can make the most of this market and secure your place as a leading lender in the state.

Tennessee’s status as the state with the fourth-highest net borrower migration offers a significant opportunity for growth. By leveraging the comprehensive analytics in our report, you can connect with more borrowers and maximize your business potential.

Request a demo

Harness the power of Maxwell Business Intelligence to enhance your organization’s data capabilities. Request a demo today and discover how our analytics can help you connect with the borrowers shaping Tennessee’s future.