Per-Loan Profit Shrinks by 32.5%, Its First Decline Since the Start of the Pandemic

Profits were down significantly for mortgage originators in 2020’s last quarter, according to the Mortgage Banker Association (MBA), which released its quarterly report on Tuesday.

How much is significant? In Q4 2020, the average net gain per originated loan was $3,738 compared to $5,535 in Q3, representing a 32.5% decline and its first drop since the beginning of the pandemic. The fall in profitability occurred despite sky-high volume. In fact, by several metrics, Q4 looked strong compared to Q3:

—Average production volume was $1.47 billion per company compared to $1.34 billion during Q3.

—Average loan volume was 5,049 per company compared to 4,732 loans in Q3.

—Average pull-through rate was 78% compared to 72% in Q3.

Rising loan production costs

The reasons for dramatically shrinking profits despite increasing volume were declining secondary market gains and climbing costs.

“Driven by strong borrower demand and a study-high in average loan balances, production volume for independent mortgage companies reached unprecedented heights, averaging close to $1.5 billion per company in the fourth quarter of 2020,” said Marina Walsh, the MBA’s vice president of industry analysis.

“Net production profits were at their third-highest levels, surpassed only by last year’s second and third quarter. While production profits were still incredibly strong in the fourth quarter, secondary marketing gains declined, resulting in an overall drop in production revenue.”

Specifically, production costs jumped in 2020’s final quarter by almost $500 per loan compared to Q3. This increase was primarily driven by personnel expenses spanning sales, fulfillment, production support, and corporate overhead. To look at this in context: Production costs in recent years have averaged out to around $6,600 per loan. In Q4 2020, those costs were $7,938, up from $7,452 in Q3.

Contributing to that increase in costs, personnel expenses reached an average of $5,426 per loan, an increase from $5,124 in Q3.

Purchase share, production revenue, & production profit

Other findings about Q4 2020 from the MBA’s report included:

—The purchase share of total originations decreased by dollar volume from 46 to 43 percent quarter-over-quarter.

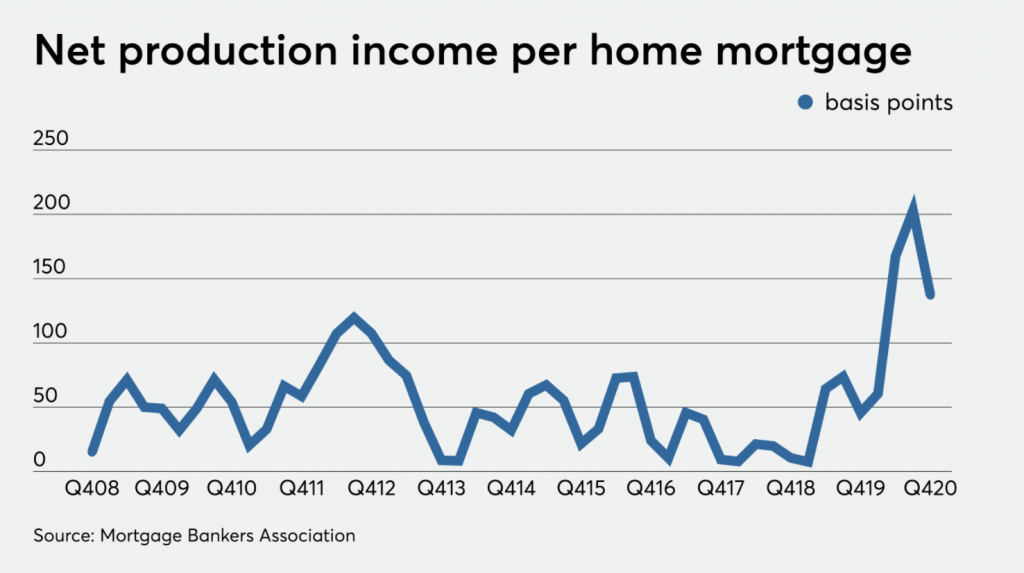

—Total production revenue (fee income, net secondary market income, and warehouse spread) dropped from 475 basis points or $12,987 per loan to 421 basis points or $11,676 per loan quarter-over-quarter.

—The average pre-tax production profit rose from 203 basis points on an average origination balance of $282,659 to 137 basis points on an average loan size of $287,131 (a record high).

The MBA’s report of declining profits mirrors some of the sentiment lenders expressed in our 2H 2020 Industry Study looking forward to 2021. Specifically, many respondents (around 37%) said they were less optimistic in 2021’s industry outlook. (A similar percentage expressed no change in enthusiasm from 2020 to 2021.)

Still, it’s important to remember that Q4’s drop in profitability still represents historically impressive numbers. For instance, 95 percent of the firms in the study posted net financial profits in 2020’s fourth quarter, down slightly from a staggeringly high 99 percent in the third quarter.

Moving forward, well-prepared lenders are likely to enjoy continued strong performance as the market shifts—even though refinance activity is drying up.

As MBA Chief Economist Mike Fratantoni said at MAXOUT, “If

you’re a purchase-focused lender, particularly focused on first-time buyers, I think the next several years are going to be very strong. We’re now forecasting $1.59 trillion in purchase volume in 2021. That’s an all-time record, and we think it’s going to keep going up from there.”