New Report: 70% of Sidelined Home Buyers Will Purchase Once Rates Hit 5.0%, and Nearly 40% Don’t Have a Lender

As rate cuts materialize and inventory recovers, sidelined home buyers will begin to take action. We created our Sidelined Home Buyer Report to dig into their challenges, plans, and approaches to home buying as they look to enter the market over the next year. For lenders looking to buoy their loan volume as the market shifts, this survey provides important context around a massive home-buying segment that will unlock over the coming months and years. Understanding, connecting with, and bending strategy to these buyers will be vital to lending success as conditions recover.

Interest rates & buying preparedness

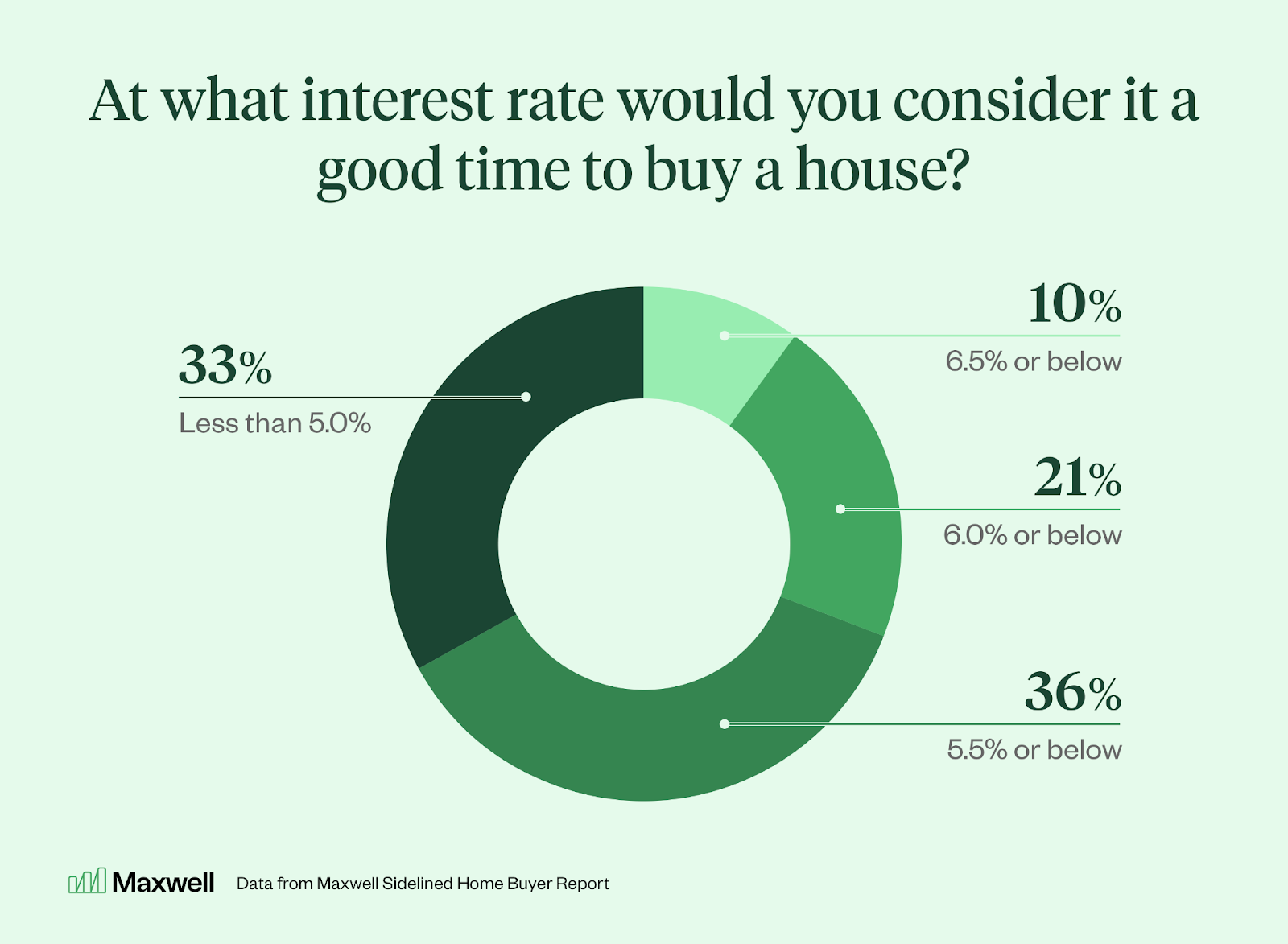

Would-be buyers awaiting better market conditions have differing opinions on the interest rate threshold they deem attractive. Of those surveyed by Maxwell, the largest segment (36%) reports it will look to buy at 5.5% or below. Another third (33%) of respondents say they’ll wait for rates to fall to 5.0% or below—meaning around 70% of sidelined home buyers plan to take action once rates hit 5.0%. Meanwhile, just 10% believe 6.5% is an acceptable interest rate at which to buy.

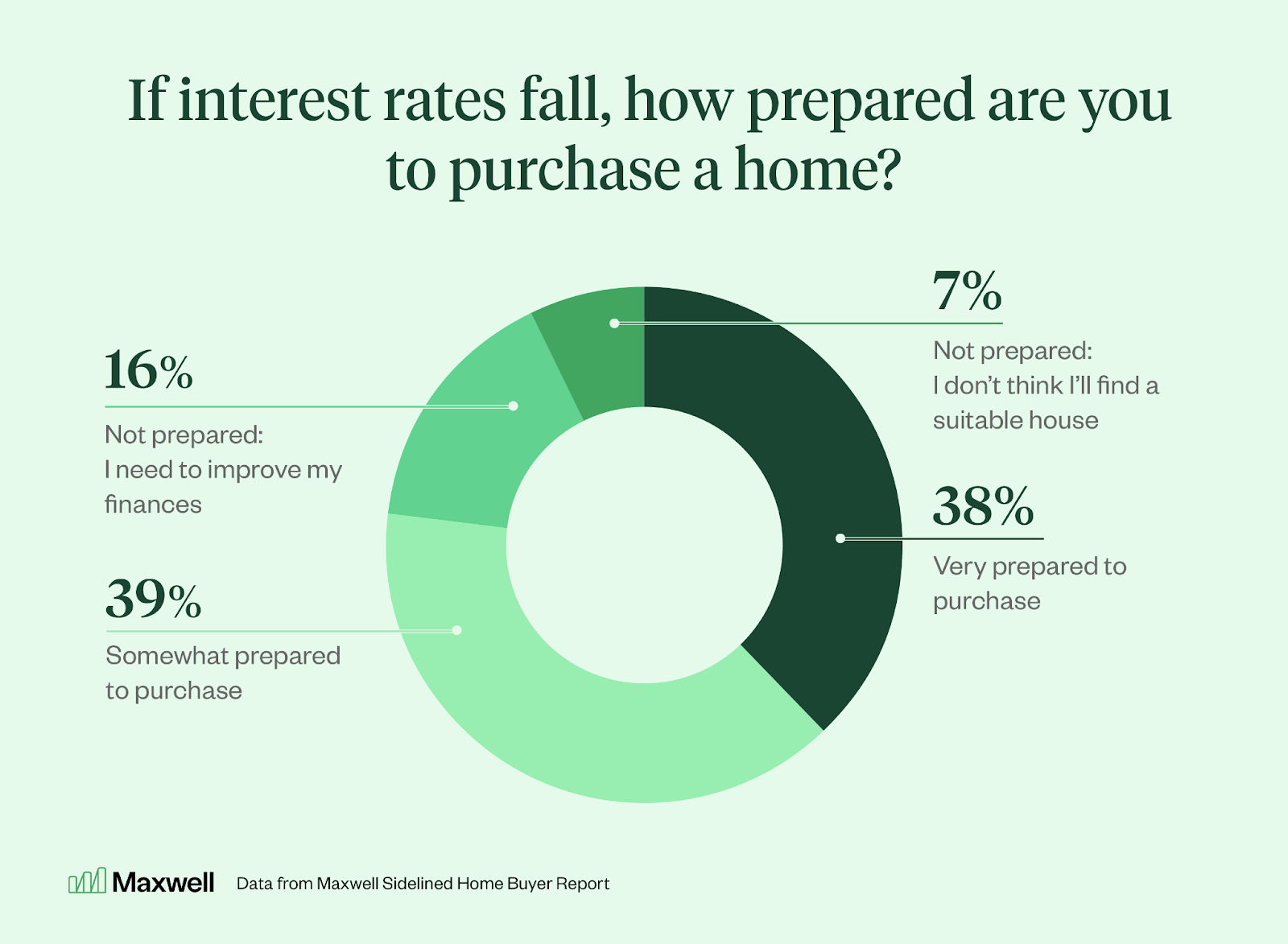

Once rates descend to would-be buyers’ preferred levels, most are poised to take immediate steps. Around 77% report being “somewhat” or “very” prepared to buy, while just 16% say they’ll need to improve their financial position first. Another 7% believe they won’t find a suitable house that meets their criteria.

“Today’s home buyers are sitting on the sidelines. They have had ample time to organize their finances, perform market research, and scour home listings,” comments John. “This extended waiting period has created a unique type of demand driven by exceptionally strong motivation, high preparedness to act, and meaningful life pressures—like a new job or a growing baby. For lenders, this segment presents an unusually immediately actionable opportunity once mortgage rates hit the tipping point.”

Lending resources

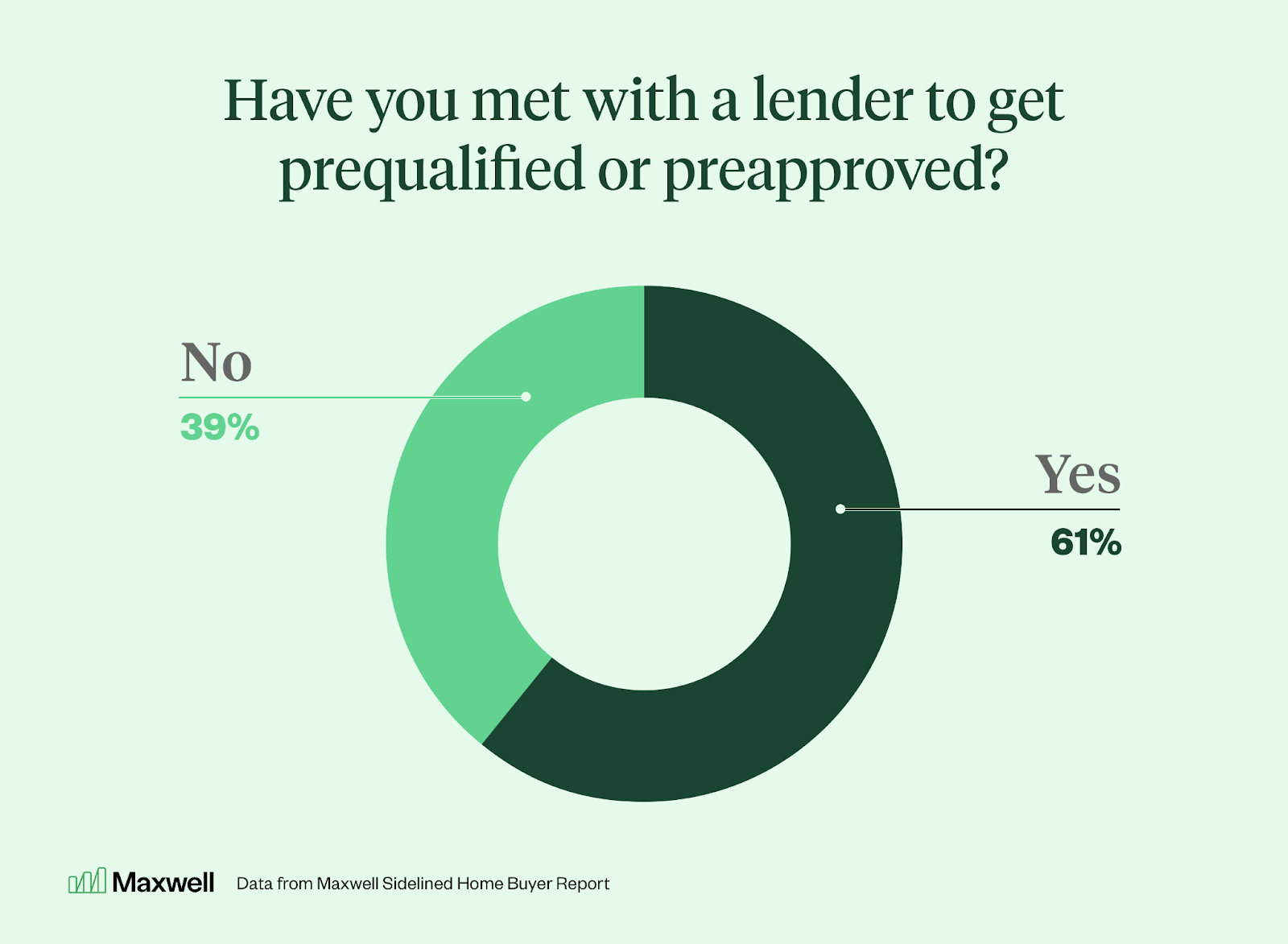

In the quest to buy a home over the next year, the majority of sidelined home buyers have gotten prequalified or preapproved for a loan. Almost two thirds (61%) have connected with a lender. Of that segment, more than half (53%) spoke with a national bank, 29% connected with a community bank or credit union, and just 18% reached out to an online lender. While many surveyed have synced with a lending resource, nearly 40% have not spoken with a mortgage professional—presenting plenty of opportunity for lenders to step up and support this segment.

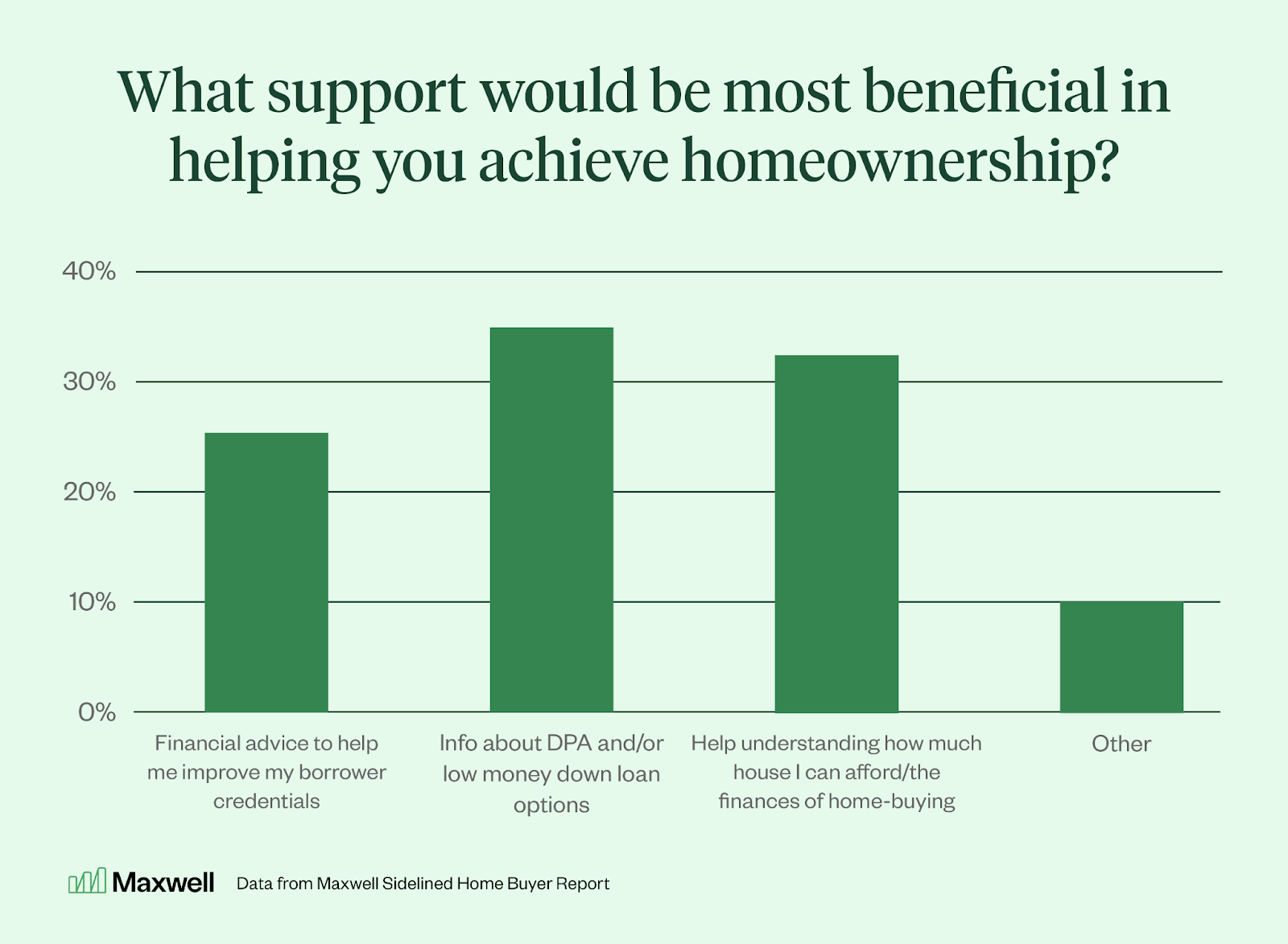

As sidelined home buyers begin to take steps towards securing a loan, they’ll look for lending and financial support. About a third (32%) report wanting more information about down payment assistance or low money down loan options. A similar percentage say they’d like help better understanding how much house they can afford and the full financial obligations related to home-buying. A quarter would benefit from advice that helps them boost their borrower credentials.

“Our survey reveals the significant number of sidelined home buyers who want active support from their mortgage lender,” says John. “They may not be literate on the array of loan products available to them, and many don’t fully understand the financial implications of housing debt. These topics are ideal entry points lenders can leverage to form relationships with would-be buyers before the market recovers.”

Learn more in our Sidelined Home Buyer Report

Download the full report to get exclusive data on sidelined home buyers, including:

- How financial qualifications impede home-buying, with over 43% of sidelined home buyers saying low credit score, high debt-to-income ratio, or lack of down payment funds keep them from qualifying for a loan

- Ways that the inability to buy a home has affected major life choices; for instance, over half say the housing market has caused them to consider relocating to a different city and/or state to find a viable option

- Why two-thirds (66%) say housing-related policy is important in who they vote for in November’s election

Get your free copy of Maxwell’s Sidelined Home Buyer Report

By submitting this form you are agreeing to our Privacy Pledge and Terms of Use. At Maxwell, we’re committed to your privacy. You may unsubscribe at any time.