New Maxwell Data: As Lenders Compete for Loan Volume, the Battle for Borrowers Heats Up

The Maxwell Mortgage Market Sentiment Report surveyed Senior Mortgage Executives on their thoughts about today’s market challenges.

As the housing and mortgage landscape continues to shift, increased interest rates coupled with rising inflation and competition are knocking lender and borrower confidence, according to findings from our recent 1H 2022 Millennial & Gen Z Borrower Sentiment Report and new Maxwell lender survey data.

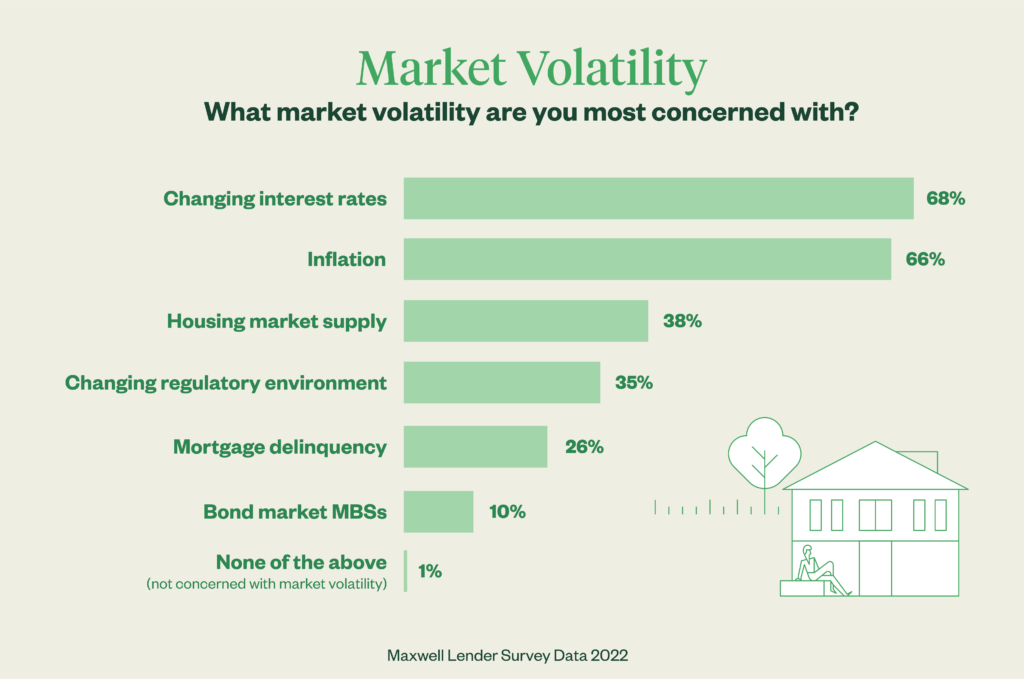

Falling mortgage demand means small and midsize lenders, who originate 40% of all U.S. home loans, are bracing themselves for significant market turbulence. Specifically, our new lender data found that 68% of lenders surveyed believe increased interest rates will affect their ability to offer competitive loans, while 66% are worried about the impact of inflation on borrowers.

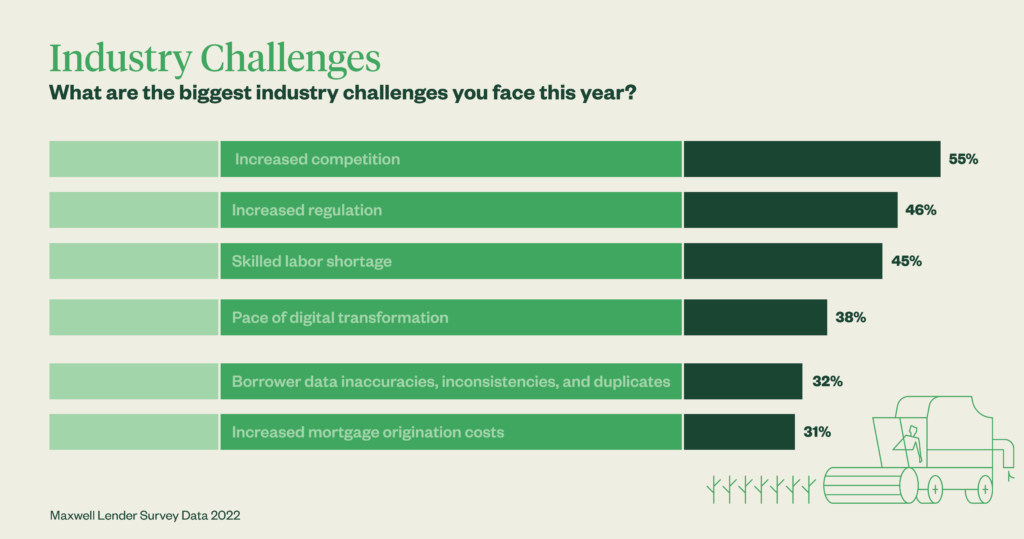

In the face of these challenges, it appears unlikely that lender concerns will abate any time soon. Today, around 48% expect a further drop in loan demand, despite recently reaching a 22-year low. As the battle for borrowers escalates, increased competition is the biggest challenge for 55% of small to midsize lenders. In this competitive environment, more than half (56%) of lenders see the rise of large online players as the main threat to their market share, while 47% are concerned with large banks and 45% with large independent lenders.

Mortgage market obstacles

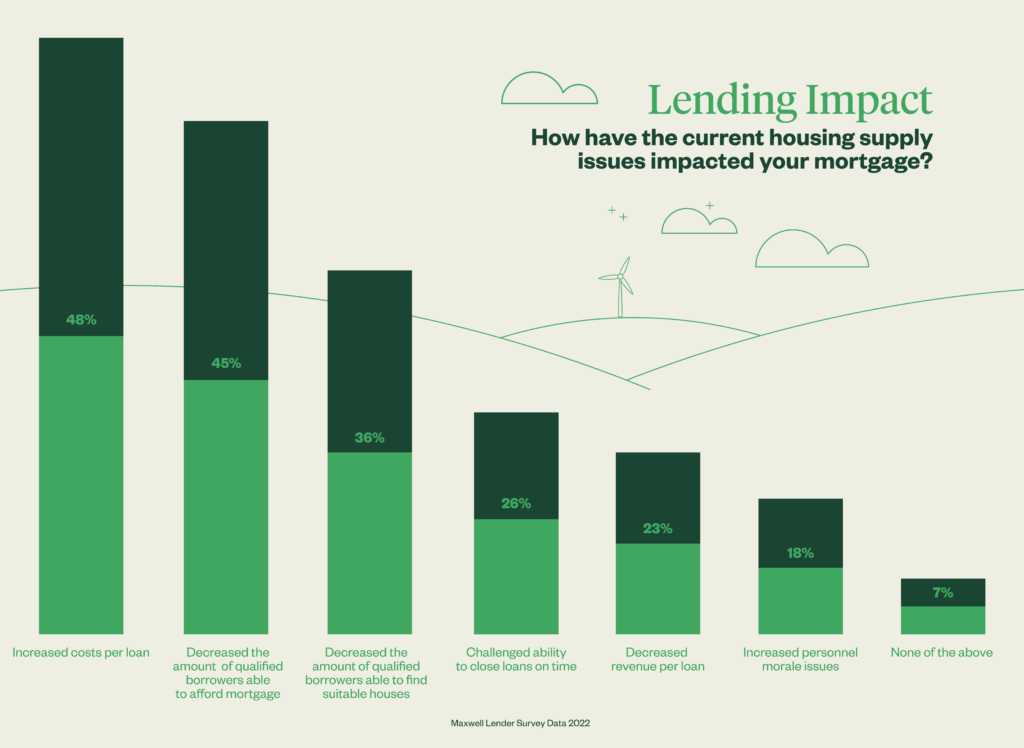

In 2022’s market, lenders are feeling the impact of an array of challenges. Namely, the increasing price of originating a loan is a top concern. Of those surveyed, 48% reported that they were grappling with increased loan costs, while 26% reported reduced ability to close loans on time, leading to increased personnel morale issues for 18%.

Lack of inventory is also a continued pain point for lenders. According to 45% of lenders, the lack of listings has impacted the number of qualified buyers able to afford mortgages. Similarly, 36% reported a decrease in the number of buyers able to find suitable houses. With more people now bidding for fewer properties and house prices expected to rise even further this year, borrowers report worry about being able to land a home, with significant percentages concerned with the impact of increased interest rates (57%) and inflation (45%) on their finances, as well as their ability to qualify (41%).

Solutions to combat difficult trends

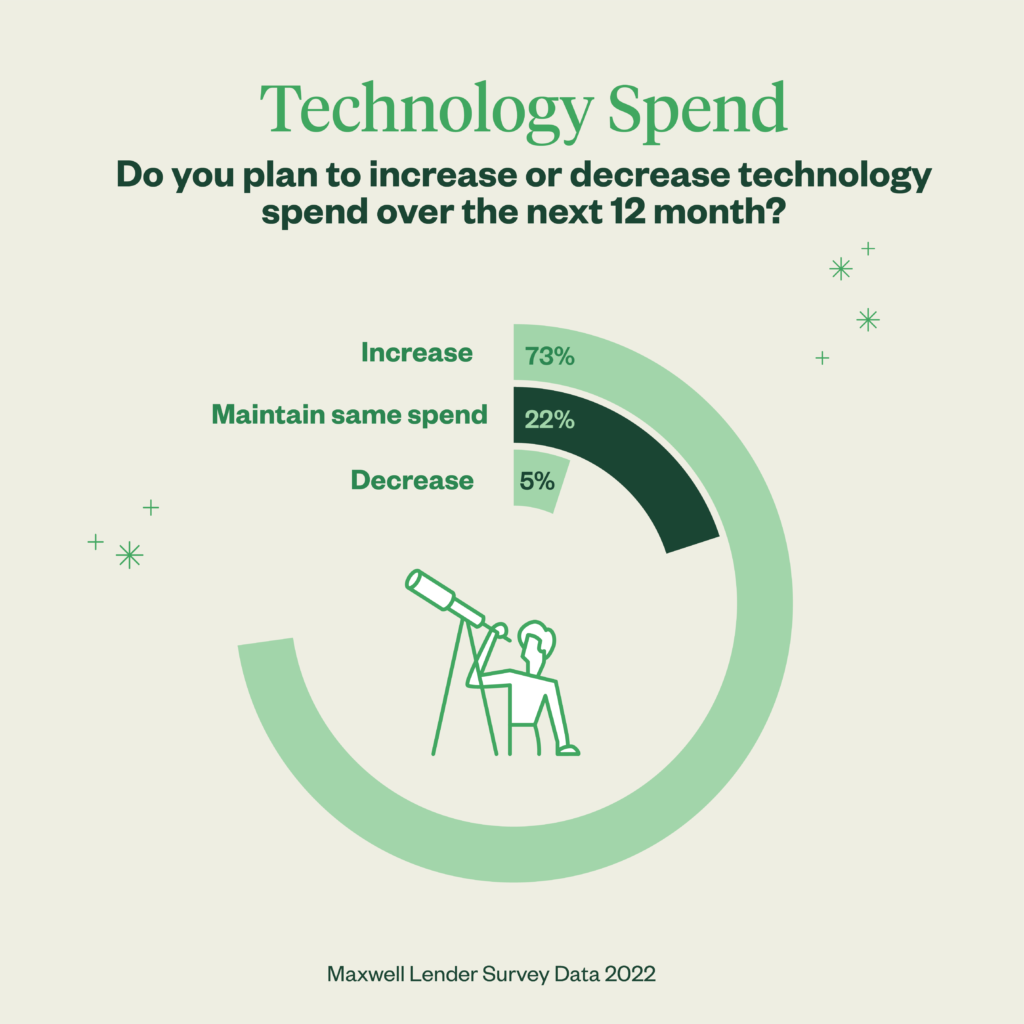

Many of the lenders we surveyed plan to proactively combat declines in volume. This includes investment in strategic technology that lends a competitive edge.

To this end, an impressive amount of lenders (73%) plan to increase their tech spend and online presence in an effort to reach more borrowers and address organizational challenges. Meanwhile, almost half (46%) plan to scale their tech to boost marketing and lead generation, and to drive more efficient application document collection, while 41% want to improve processing and fulfillment to offer faster home loans.

Winning borrower business

Our recent 1H 2022 Millennial & Gen Z Borrower Sentiment Report gives interesting insight into the priorities and lender preferences of today’s home buyers. For instance, our data found that 79% of millennials and Gen Z borrowers intend to shop around for a mortgage, with 85% preferring a traditional financial institution (i.e. banks and credit unions) over an online lender (15%). Plus, while 38% believe a personalized, in-person and an online mortgage experience are as important as the other, surprisingly, a larger percentage of future homebuyers rated face-to-face support (35%) as more important than an online mortgage experience (27%).

Still, it will pay for lenders to extend their online reach in the quest to earn borrower business. Large numbers of millennials and Gen Zs are leveraging rate comparison sites (59%), online review comparisons (50%), and lender websites (46%) in their search for a lender. Thirty-three percent reported they would use social media advice from platforms such as TikTok.

“With almost 47% of future homebuyers valuing a sense of trust in a lender and 44% looking for speed and efficiency, lenders must offer one-on-one, human-led service in conjunction with modernized processes to win in today’s competitive market,” commented John Paasonen, Co-Founder & CEO of Maxwell.

As housing supply, interest rates, and inflation continue to drive fierce competition, it’s vital for lenders to lean into their borrower experience while exploring technology-led solutions that can boost efficiency and profitability.