eClosing with Snapdocs and Maxwell: a Better Experience for Lenders & Borrowers

Most lenders today have invested in point-of-sale technology to streamline their operations and meet borrower expectations. Still, manual closing processes continue to serve as a bottleneck within the lending process, causing delays, errors, and frustration for all participants.

Closing has historically been fragmented and paper-heavy, often with over 15 stakeholders who each have their own technology, document types, and state and county regulations. It’s no wonder, then, that even lenders who have added efficiency-boosting technology into their processes continue to struggle with gains in the clear-to-close process.

Digital closing technology solves these challenges by eliminating operational efficiencies and simplifying the closing. In fact, National Mortgage News reports that lenders can save over $444 on their loan costs when using full eClosing, while reducing the closing time by 157 minutes.

That’s why we partnered with Snapdocs—to help lenders accelerate digital closing adoption, and deliver a streamlined experience to borrowers and the loan officers who serve them. The Snapdocs’ eClosing platform connects all participants, processes, and technologies to power a fully digitized closing, at scale. The platform standardizes all closing types, enabling faster and more profitable closings. Lenders benefit from Snapdocs’ proprietary AI-powered technology, which reduces manual tasks, eliminates errors, and provides a seamless and automated borrower experience.

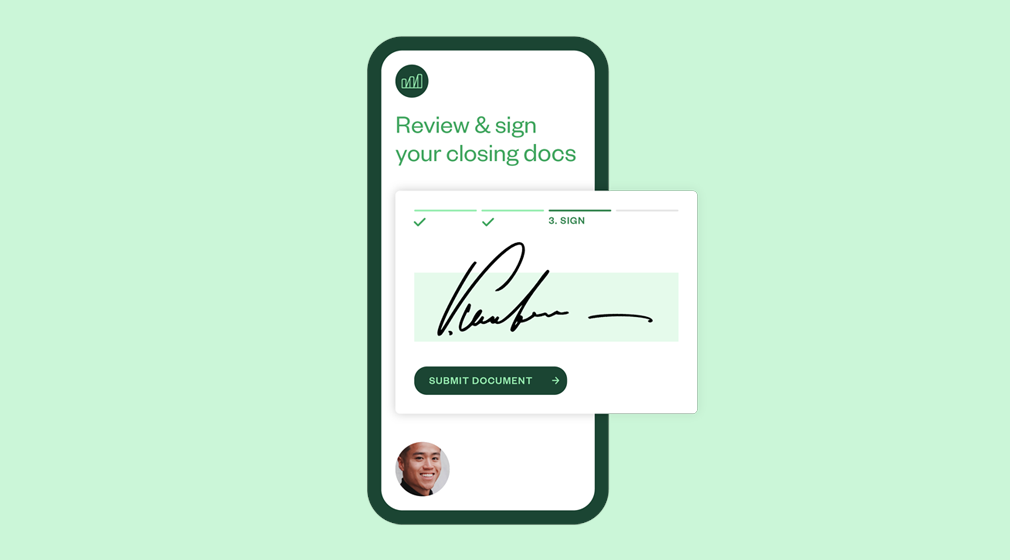

Maxwell Point of Sale effortlessly integrates with the Snapdocs eClosing platform, providing our customers a unified experience from loan application to final signature. By integrating our platforms, borrowers can start and complete their mortgage transaction within one familiar platform. No additional logins or interfaces are required. Meanwhile, lenders receive closing updates in real time through a secure stream of data, reducing the time and costs of these otherwise manual processes.

Specifically, Snapdocs eClosing:

- Supports a variety of closing options including wet sign and hybrid closings

- Frees LOs from creating task lists, communicating deadlines, sending reminders, and coaching borrowers to prepare for closing

- Keeps the borrower in the point of sale from start to finish

- Exceeds borrower expectations with the ability to preview and sign documents before closing day

- Empowers LOs with automatic preparation of all lender and title documents

Plus, Snapdocs has the industry’s largest settlement and notary network, which means lenders can confidently maintain a digital closing from start to finish.

As loan costs rise, competition increases, and borrower expectations change, the use of eClosing technology is only becoming more vital to lender success. In today’s margin compressed environment, local lending teams need every advantage at every step of the process to support profitability. Closing is a vital aspect of that process, where lenders can not only unearth time and cost savings, but take an opportunity to wow their borrowers one last time on the path to homeownership.