Encompass Integration

Integration benefits for Encompass® users

Maxwell’s partnership with Encompass enhances the technologies you use every day, empowering your lending team to achieve more with less effort.

Integration Overview

Simplify your workflow

Our bi-directional integration between Encompass and Maxwell enables lenders to send loan application data, synchronize borrower documents, and trigger status notifications to borrowers and real estate agents without leaving Maxwell.

- Borrower data. All borrower application data gathered in Maxwell flows securely to your LOS.

- Loan milestones. Changes in the LOS sync with Maxwell to maintain consistent communication to borrowers, co-borrowers, and real estate agents.

- Documents. Any documents collected in Maxwell are sent directly to the borrower’s folder in Encompass.

- Disclosures. With no additional cost or third-party implementations, Maxwell’s disclosure solutions enable you to keep your standard workflow to initiate disclosures.

Disclosures

Streamline the disclosure process

Maxwell’s integration with Encompass simplifies the traditionally complex disclosure process. Instead of fumbling between two systems, lenders and borrowers access a seamless disclosure experience within the Maxwell platform.

By fully syncing with Encompass, lenders meet regulatory requirements essential for compliance while easily delivering disclosures. Meanwhile, borrowers avoid the need to access the LOS with a separate login. The result is happy compliance teams and informed, satisfied borrowers.

Optimal Blue Integration

Pricing for modern lending

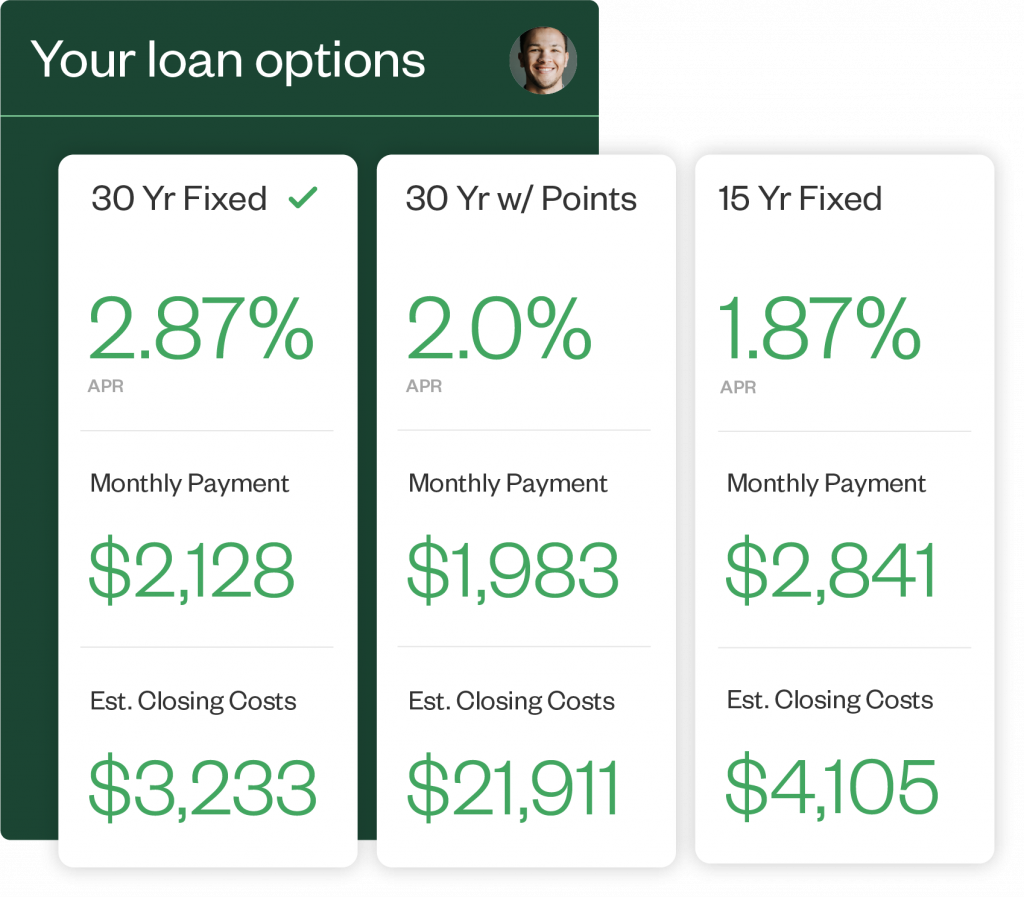

Our integration with pricing leader Optimal Blue enhances the Encompass experience, enabling loan officers to run and save scenarios with minimal borrower information. Review, save, and curate the best products for your borrowers in one intuitive interface.

- QuickPricer. Maxwell’s QuickPricer feature allows loan officers to search for loan products quickly and easily, facilitating pricing discussions with potential leads and borrowers.