5 Myths About Millennial Homebuyers (and How to Attract Millennial Business in the Post-COVID Era)

COVID has, obviously, shaken up the mortgage market in ways we couldn’t anticipate, and while we can’t predict the future, it’s a safe assumption to make that millennials will continue to dominate the market whether the mortgage market continues to boom or goes bust.

The pandemic has forced the hand of many lenders to rapidly adopt technology to accommodate our new, largely remote world. This may help mortgage lenders better attract first-time millennial homebuyers in the future, as the pandemic-driven technology is helping them close the gap between borrower experience and expectation.

But especially if the market compresses and we see stiffening competition in the mortgage space as the economy rides out the impact of COVID-19, understanding how best to serve millennial homebuyers looking to enter the market will be crucial to enduring success as the market recovers.

Lenders looking to better serve the millennial generation should make an effort to cut through the crap and confront the millennial stereotypes that older generations have come to believe as fact.

Misconceptions abound about the millennial generation. Often treated as a scapegoat by the media for the less-savory elements of our current culture, millennials have gotten a bad reputation. Media coverage of the millennial generation is often condescending and over-exaggerates the perceived shortcomings of the group as a whole.

There is no clearer example of this than this excerpt from TIME Magazine’s controversial 2013 cover story entitled “The Me Me Me Generation: Millennials are lazy, entitled narcissists who still live with their parents”:

“What millennials are most famous for besides narcissism is its effect: entitlement… Millennials got so many participation trophies growing up that a recent study showed that 40% believe they should be promoted every two years, regardless of performance. Their development is stunted: more people ages 18 to 29 live with their parents than with a spouse, according to the 2012 Clark University Poll of Emerging Adults. And they are lazy. In 1992, the nonprofit Families and Work Institute reported that 80% of people under 23 wanted to one day have a job with greater responsibility; 10 years later, only 60% did.”

Though it has been several years since that story was published, it’s indicative of how millennials have long been covered in the media. These media portrayals have, however imperceptibly, influenced how the general public perceives millennials.

A few quick Google searches as I began to research for this blog illustrates what I mean. Before I could even fully type out my search queries, Google’s auto-complete function showed me the negative view the public has about millennials:

These search phrases show two distinctly different perceptions of millennials, one that sees them as entitled and thin-skinned, and another that views them as a group defined by economic distress.

The former perception is ill-conceived and — particularly for businesses trying to benefit from the growing buying power of the millennial generation — counterproductive.

These misconceptions may be coloring how executives view millennial consumers, and thereby preventing companies from accurately understanding and addressing the needs and wants of millennial consumers.

To capture the business of this blossoming generation of homebuyers, it’s imperative to break through the generational stereotypes and understand what commonalities actually exist for this generation.

That’s why we’ve set out to debunk some of the most common myths about millennial homebuyers so lenders can better serve millennials as some flock towards the housing marketing during (and in the wake of) COVID-19.

Myth #1: Millennials value experiences over things

Before COVID, there was ample research to show that millennials prioritized experiences over material items. But as the pandemic rages on and bars, restaurants, concerts, and the like continue to be inaccessible, the draw towards homeownership for millennials is beginning to increase.

As Conor Sen argued in Forbes back in April, COVID-19 may re-wire millennial preferences in a more domestic direction.

“Homeownership, especially among millennials, fell out of favor amid distressed personal finances and changes in mortgage regulations while the rise of smartphones, social media and services such as Uber and Airbnb nurtured a consumer culture focused on dining, travel and events,” Sen argues.

“A post-coronavirus, pre-vaccine world will upend this lifestyle, which will likely be replaced with the consumption patterns of older generations. As long as social distancing and fears of getting the virus persist, consumers probably will spend more on the trappings of their homes rather than services and experiences involving public spaces and crowds.”

While COVID-19 has brought economic strife to many, for millennials who are able to maintain job security and financial stability, homeownership may begin to look more and more appealing as older millennials, whether it be out of necessity or choice, trade their social lives and preference for experiences for a more traditional investment in their home lives.

Myth #2: Millennials are entitled

The economic fallout from COVID-19 has thrust millennials into their second ‘once-in-a-lifetime’ economic recession. The path towards homeownership has been rocky for many millennials, even those who have been willing to work hard and are well-educated.

When Boomers were young adults, they enjoyed a net wealth more than twice that of young adults today. Student borrowers have seen their net wealth decimated in two generations.

Young Boomers with college debt in 1989 had an average net wealth of $86,500, while the same cohort of millennials today demonstrate a net wealth of $6,600.

I have seen how this plays out personally. My parents bought their first home at 20 years old. Neither of my parents held college degrees, and they were able to afford their first home on a single income. Meanwhile, with two degrees from Top 20 private universities (and saddled with $130k in student loan debt), my first ‘real’ job out of graduate school payed $39,000. Thanks to my education, I’ve been able to climb the ranks quickly, but even so, between student loan debt, soaring home prices, and my desire to own a home as a single woman, homeownership realistically won’t be feasible for me until my mid-30s.

“[Millennials] want roughly the same things regardless of when they were born: to be given interesting work to do, to be rewarded on the basis of their contributions and to be given the chance to work hard and get ahead.” — The Economist

It’s unfair and unrealistic to judge millennials against the same yardstick of success (homeownership, marriage, kids) that their parents were measured against because they are battling a whole new host of problems that their parents didn’t have to.

Myth #3: Millennials are lazy

Millennials are pushing for raises every two years because they’re underpaid, not because they’re entitled. More millennials (15% as of 2016) are living at home not because they’re lazy, but because they can’t afford not to.

Wages have not kept up with property prices, and the lack of affordable housing has led to a boomerang generation with more millennials living at home. 43% of those living at home believe they will move out in the next two years but another 43% expects to still be living at home three years from now.

The average millennial makes 20% less (adjusted for inflation) than the previous generation, carries $30,100 in student loan debt, and would be crippled by an unexpected $500 emergency expense.

The fact that 51 percent of Millennials own or intend to own a business flies in the face of the notion that millennials are lazy. In fact, they have already launched twice as many businesses than boomers ever have, a number that is sure to increase as the millennial generation ages and becomes more financially stable.

Myth #4: Millennials aren’t buying homes because they love renting and hate responsibility

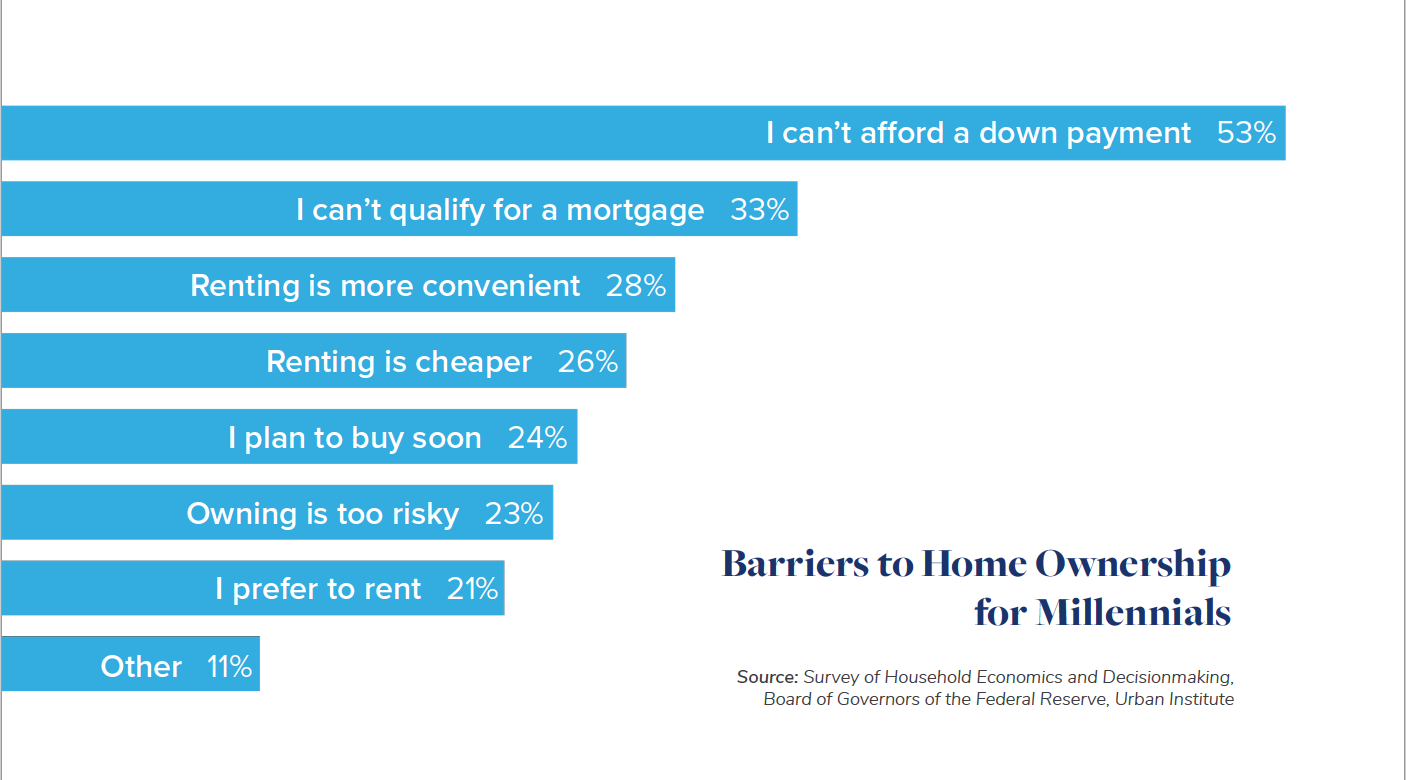

When young renters were asked about their primary reason for renting in Fannie Mae’s survey for their report, “What Do Consumers Know About The Mortgage Qualification Criteria”, their top response was that they are making themselves financially ready to own.

Combined with the answers “renting is a more affordable option” and “cannot obtain a mortgage,” 57% of those in the Fannie Mae survey cited financial reasons for not buying a home. Post-college millennials living with their parents also reported not having enough income as their primary reason for staying at home.

Some critics chastise millennials for their prolonged adolescence, as if millennials are all choosing to forgo adult responsibilities in favor of a more carefree lifestyle. Perhaps that’s true with regard to marriage and children, but most millennials delayed home ownership because they had no other choice.

“Millennials are often referred to as a “renter generation,” because they have prioritized furthering their education and thus delayed getting married and having children, which are critical lifestyle triggers to buying a first home,” writes Mark Fleming, chief economist for First American Financial Corporation. “However, the dream of homeownership is far from dead for this age group.”

Millennials aren’t choosing not to buy homes. Millennials aren’t renting because they want to shun commitment and convention. Millennials rent because they have to.

Increasing education debt has increased millennial debt-to-income ratios and made it more difficult to save for a down payment, all while rental costs skyrocket and further depress millennial saving capacities.

Contrary to what some might believe, most millennials aren’t choosing to rent because they want to. Renting is not a lifestyle choice; it’s their only option.

Myth #5: Digital is the end-all-be-all

We can’t deny the fact that millennials are ‘digital natives’. They’ve grown up with technology and social media, and these tools are natural, integral parts of their lives and how they purchase.

BUT that doesn’t mean millennials want an all-digital experience (especially when it comes to mortgages).

Millennials are both tied to technology and aware of how it negatively impacts their lives. One study by the American Psychological Association reported that millennials often feel disconnected from others — including their family — and blame their over-connected digital lives, a phenomenon that has no doubt worsened as we all feel more isolated in quarantine in the midst of this pandemic.

The average millennial checks their phone 43 times per day (assuming we are getting 8 hours of sleep, that means millennials look at our mobile devices almost three times per hour).

As ‘digital natives’, millennials are naturally the most likely use both online (92%) and mobile platforms (79%) as consumers, and they use those digital platforms more frequently than other generations.

That said, millennials still want human relationships at the center of the mortgage experience. Deloitte research shows that millennials demand an integrated, seamless experience regardless of the platform. That means that being able to transition effortlessly from gathering information on your mobile website to easily scheduling an appointment to sit down with a loan officer (virtually, for now) to get more information.

It’s time to apply new technologies and platform to enhance understanding and confidence while simplifying the experience. Millennials have a stated preference for a simple, streamlined mortgage process.

Opportunities for lenders

— Lead with empathy and education

Easy-to-follow guides and checklists are one way mortgage technology can help lenders meet those preferences and keep millennial borrowers comfortable throughout the process.

“Lenders need to prove our knowledge and experience. Let this generation know what to expect and be engaged throughout the process. Be relevant and customized with what we’re sharing with them.” — Amy VandeSand, Director of Consumer Market Research/FVP, SunTrust Bank

— Prioritize the relationships at the center of the mortgage transaction

The relationship at the heart of the origination transaction is paramount to winning (and keeping) millennial business. Ellie Mae’s 2018 Borrower Insights Survey found that 37% of millennial homeowners said more face-to-face interaction and more thorough communication with their lender would have improved their last mortgage experience.

— Make it easy for them to get information and assistance throughout the mortgage process

Millennials want easy, convenient access to their real estate agent and loan officer when they need it. Younger customers often feel more comfortable and familiar with live chat than they do with phone support or email; and according to a consumer study by American Express, 6 out of 10 U.S. consumers say their go-to channel for simple inquiries is a digital self-service tool (such as website, mobile app, voice response system for online chat).

— Lead with great customer service

This is a generation with higher customer service expectations than their predecessors, and if you can offer superior customer service and foster meaningful borrower-loan officer relationships, millennials will keep coming back for more.

Conclusion

Economic strife aside, the buying power of the millennial generation is still significant, and the influx of millennial home buyers is just beginning. With a median aged of 33, roughly six out of 10 first-time home buyers are millennials, and millennials are expected to form 20 million new households by 2025.

“Millennials are shaping the market more than anyone realized. In fact, half of all buyers are under 36 and half of sellers are under 41.” — Jeremy Wacksman, Chief Marketing Officer, Zillow

Millennials have already ousted Boomers as the largest living generation, with numbers that continue to grow as millennial immigrants pad their already substantial numbers. Millennials are changing the market faster than we even realize, and the lenders who will lead the industry in the years and decades to come will be those who can empathize with the millennial plight and tailor the mortgage process to their unique preferences.

“As they’ve grown up, Millennials have continued to grow their wealth and their families and are now occupying the heart of the financial services market,” says a report from Edelman entitled Millennials With Money. “Whenever a generation ages, organizations that serve that market will need to adjust their assumptions, communications, and even their operations.”

You will not resonate with a millennial audience without true understanding and empathy, and this eBook seeks to both provide a more accurate depiction of millennial home buyers and equip you with tangible ways to better cater to your millennial borrowers.