Introducing the Maxwell Point of Sale Mobile App for Loan Officers on the Go

Modern loan officers need to transact business where business is, and that’s not necessarily in the office anymore. Whether at lunch meetings, networking events, golf outings, open houses, or other community events, top-producing LOs are getting out of the office to meet people, build relationships, and generate business. These are not exactly the most convenient environments to lug a laptop—and yet 73% of loan officers report that pipeline management, an activity that traditionally requires them to sit at a computer, takes up most of their time.

Untethering from the desktop is necessary for LOs to build relationships and build their business. This makes it crucial to provide LOs with a robust, on-the-go solution that will keep up with them so they can keep up with their pipeline from anywhere.

Pipeline management and communication on the go

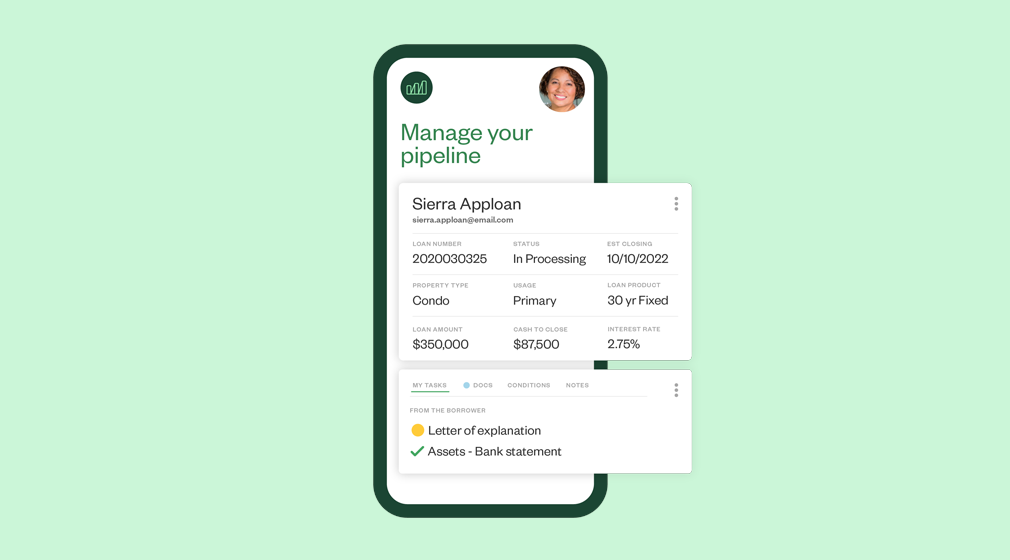

The new Maxwell Point of Sale app is designed to give loan officers a tool they can use to manage their pipeline and serve their clients wherever they are, right from their mobile device. Native to both Android and iOS operating systems, the Maxwell mobile app gives LOs the functionality of Maxwell Point of Sale in a nimble, mobile-first format.

The Maxwell Point of Sale app retains proprietary features from the desktop version that LOs love, empowering them to handle more loan files and close loans faster without disrupting their workflows even when away from the office. Loan officers can build and manage their pipeline, keep in contact with their existing clients, and act fast to satisfy borrower expectations all while working out of pocket.

Offering the flexibility of a mobile experience without sacrificing functionality, the new app allows LOs to:

- Start a loan file with just the borrower’s name, email, and phone number, capturing leads when and where LOs find them.

- Provide the borrower a link to begin the loan application without any delay or additional communication, turning a lead into a loan.

- Track milestones, identify loan files that need attention, and act on borrower needs.

- Receive push notifications whenever a borrower completes a milestone or uploads a document to stay up-to-date.

- Act on borrower activity and trigger next steps immediately, reducing closing time and increasing responsiveness.

As the industry expands its digital presence, providing LOs with the tech they need to keep pace with emerging trends and perform their jobs more efficiently will be imperative to attracting and keeping top talent. With the Maxwell Point of Sale mobile app, loan officers do not need to press pause when they step away from their desk. Loan file progress can continue to move forward, and borrower needs can be placed at the forefront. The app gives loan officers the tech they need to quickly respond to action items with a full view of their pipeline, closing more loans faster and exceeding borrower expectations from anywhere.

Borrower interactions don’t just take place at the office, and borrowers deserve personal interactions with each touchpoint, regardless of where or how it occurs. With updated information and enhanced communication tools available in the office, at an event, or anywhere else, LOs using the app can deliver the level of service borrowers crave without having to choose between facetime and pipeline.