MBA Chief Economist Mike Fratantoni’s 4 Key Predictions for 2021

With loan origination volume likely to reach a record-breaking $3.9 trillion in 2020, there’s no denying it’s been a banner year for the lending industry. But as refinances wind down in 2021, where will the market trend? And how will significant factors like shifting presidential power and a lingering pandemic come into play?

Like other elements of the economy, the mortgage industry has been thrown into an unprecedented arena—making it the perfect time to turn to Mortgage Bankers Association (MBA) Chief Economist Mike Fratantoni for expert predictions on 2021 and beyond.

At MAXOUT2020 Fall last week, Mike spoke extensively in his session “Economic and Mortgage Outlook” on his forecasts for the next several years, covering everything from specific rates to macroeconomic trends. In a hot-off-the-press report unveiled at MAXOUT, Mike painted a hopeful economic outlook for housing—with a few caveats.

Let’s look at some of the major factors that will shape the market in 2021 and beyond.

1. The election will result in a moderate rate path.

The MBA had already baked a Biden administration win and divided Congress into its forecast, a prediction that appears to be coming to fruition. However, this outcome surprised many who had projected a “Blue Wave” to sweep statehouses long controlled by Republicans.

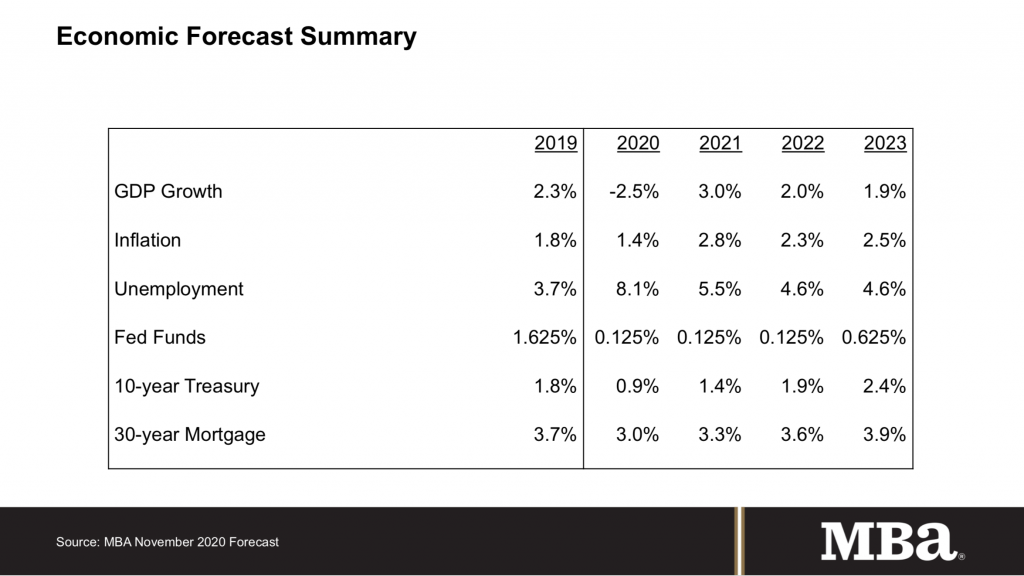

The more tempered results spurred an alternate prediction calling for a much more moderate rate path, with short-term rates locked at the lower bound by the Fed. Still, the most likely trajectory over the next few years will include a steepening yield curve and increases in 10-year treasuries and 30-year mortgage rates.

2. A coming vaccine could help to boost the economy.

Recent positive news about the efficacy and speed of COVID-19 vaccines from Pfizer and Moderna resulted in a positive stock market reaction and stronger yields. If a vaccine continues to proceed to market as planned, economic growth will likely accelerate. Because of this development, Mike is forecasting a slightly higher rate path.

3. The job market’s rebound will spur further economic recovery.

Perhaps most surprisingly, the October jobs report included an increase of 638,000 jobs over the month. The unemployment rate dropped a full percentage point, from 7.9% to 6.9%. In fact, Mike predicts unemployment to drop to 6.5% by the end of 2020, and 5.0% by the end of 2021.

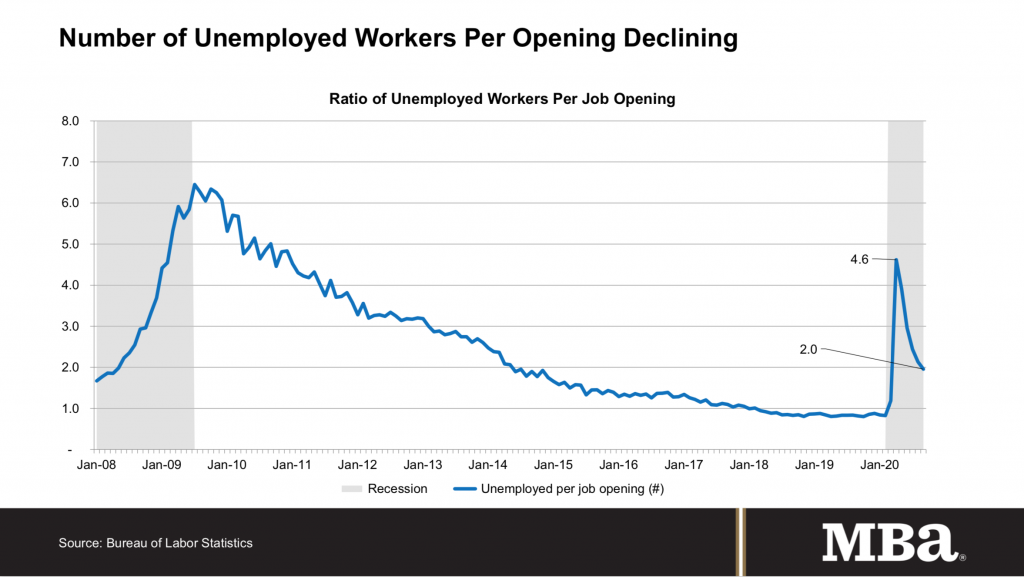

When it comes to job loss, 2020’s crisis has differentiated itself from the Great Recession of 2008–2009 in several important ways. In late 2009 and early 2010, at the heart of the housing crisis, 6.5 unemployed people existed for every job opening. At the worst part of 2020’s pandemic, that number was 4.6. This metric, among others, lead experts to believe that this year’s financial crisis may prove more easily recoverable. In fact, the current number of unemployed workers per job opening as of this writing is only 2.0.

While comparing the current recession to 2008 unearths some good news, many industries, such as travel and events, are obviously still suffering. What’s important to point out is that job loss has largely been contained to certain sectors, unlike during the Great Recession, when businesses across the board experienced massive losses. As any mortgage professional knows, various industries, including lending, have been growing faster than they can hire in 2020. These conflicting factors have led to stronger than anticipated recovery.

4. Inflation will rise, pushing in the direction of higher rates.

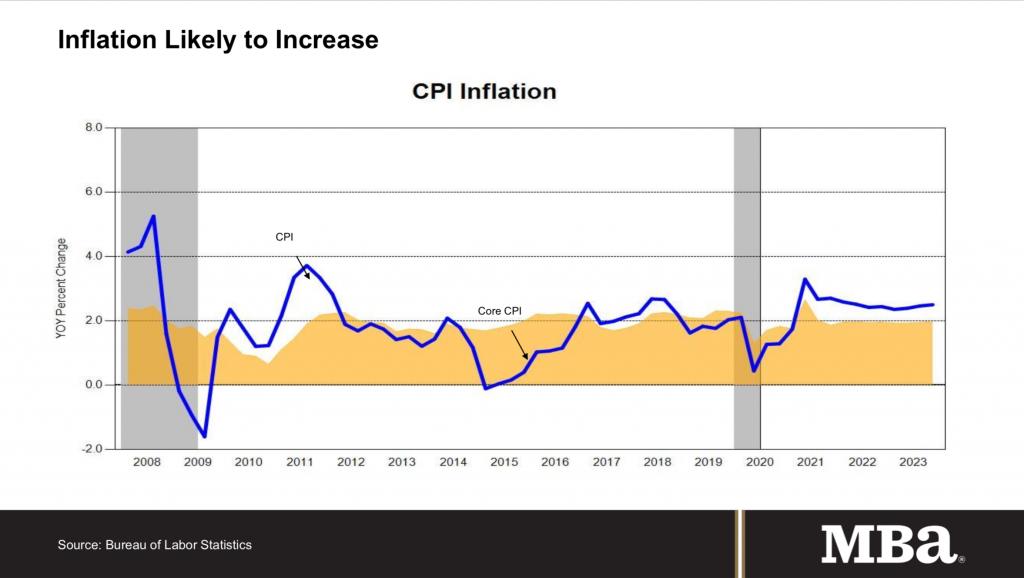

In August of this year, Federal Reserve Chairman Jerome Powell rolled out an entirely new monetary policy framework called flexible average inflation targeting. Altering the Fed’s decades-long approach of targeting 2% inflation, the new strategy will aim for 2% average inflation over time. This means actual inflation could fall above or below that mark.

The move sends clear signals that the Fed will tolerate higher inflation before raising short-term rates. Because of this change, rates will likely stay at the zero bound at the short end of the curve longer as inflation picks up. The Fed is asking for a higher inflation rate and setting an environment for that to happen. Therefore, we have reason to believe that inflation will be higher in the coming years—a trend that would likely put upward pressure on rates.

Interesting, unprecedented market conditions in 2021 and beyond

These four factors spell out a lending environment with fairly low—but not “2020 low”—rates over the next few years. This trend, along with a changing demographic landscape, will have repercussions on both refi and purchase volume.

“Our latest estimate pegs 2020 at almost $3.4 trillion in volume. That’s almost $2 trillion in refi and $1.4 trillion in purchase. And that $3.4 trillion is second in time only to the all-time record in 2003 of $3.8 trillion,” said Mike. “We think next year, with just somewhat higher rates, you’re going to see a fairly sharp falloff in refi activity, particularly in the second half of the year.”

Of course, there’s much more to the story. Mike’s in-depth analysis included results from the MBA’s Lender Performance Roundtable Group Survey and Servicing Operations Study, as well as:

—How worldwide deficits created by the pandemic will affect mortgage rates

—Why 2021 is likely to be a record-breaking year for purchase-focused lenders

—The reason why inventory (or lack thereof) could throw a wrench in 2021’s recovering housing market

—The future of credit and loan product availability in a post-COVID world

—Why home price growth will likely decelerate in 2021

—The promising (and surprising!) metric about borrowers in forbearance that further supports a promising economic recovery

—19 additional charts that illustrate where lending will head over the next several years!

Ready to arm yourself with an experienced economist’s predictions for housing and lending as we head into (more) unprecedented economic territory? Watch Mike Fratantoni’s entire presentation and access the slides below!