QUICKPRICER

Pricing for modern lending

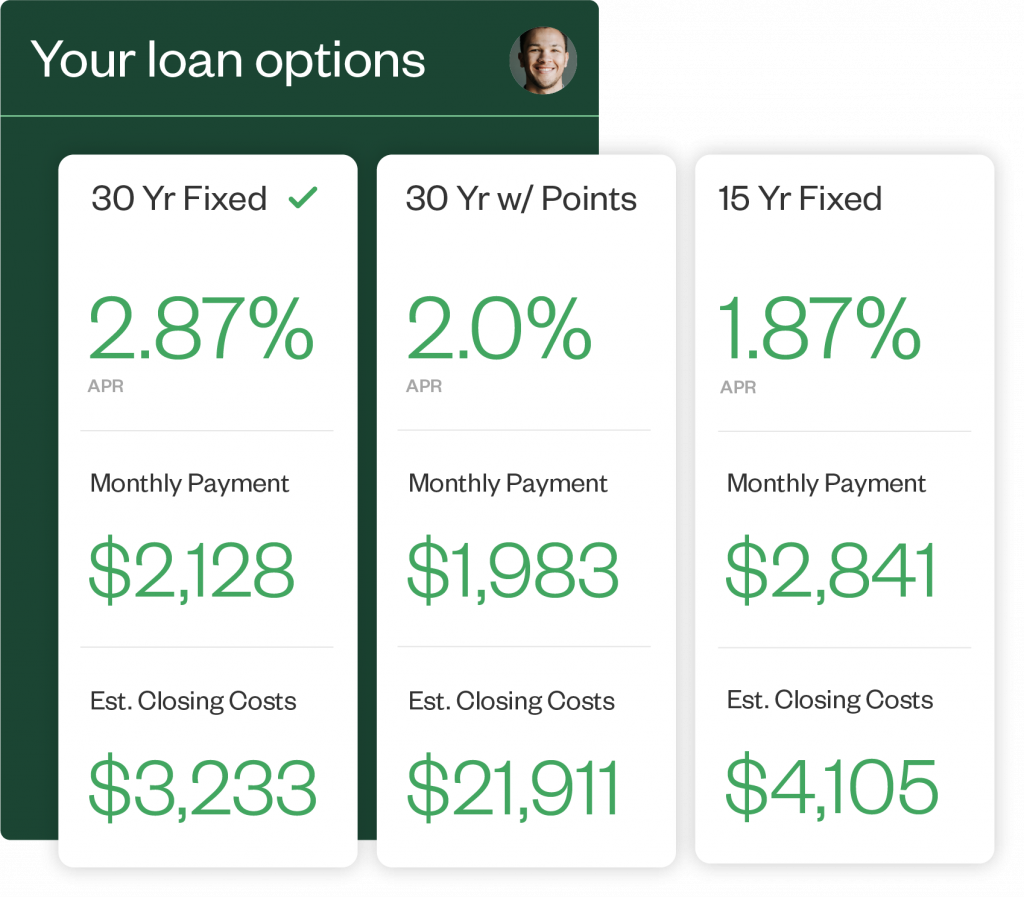

QuickPricer provides hassle-free loan product searches for pricing discussions with leads and borrowers.

QuickPricer with Optimal Blue

With QuickPricer, loan officers don’t need to create a borrower or wade through hundreds of fields. Instead, they can quickly offer borrowers easy-to-understand pricing scenarios, allowing for spontaneous, one-on-one interactions. QuickPricer is available for customers leveraging the Optimal Blue pricing engine.

Quick and easy

Use QuickPricer’s intuitive interface to facilitate fast loan product pricing options. Run a scenario for anyone to give quick options on the go.

Engaging

Foster trust and rapport with borrowers through QuickPricer’s readily understandable information, presented in a comprehensive, professional report.

Compare & Share

Create and send multiple pricing scenarios, educating the borrower and driving them into the loan application.

Mobile-first

Help LOs facilitate pricing discussions no matter where they are with QuickPricer’s mobile-friendly interface.

Faster results

Experience fast estimations with minimal inputs, allowing LOs to engage leads and convert more to borrowers.