[eBook] Mortgage Fraud, Past & Present: Tips for Protecting Your Business from Fraud

It seems like every day I see another article in HousingWire or MBA detailing the case of someone who was caught committing mortgage fraud.

The biggest threat right now in the industry might seem like margin compression and increased competition, but don’t sleep on the rising threat of fraud.

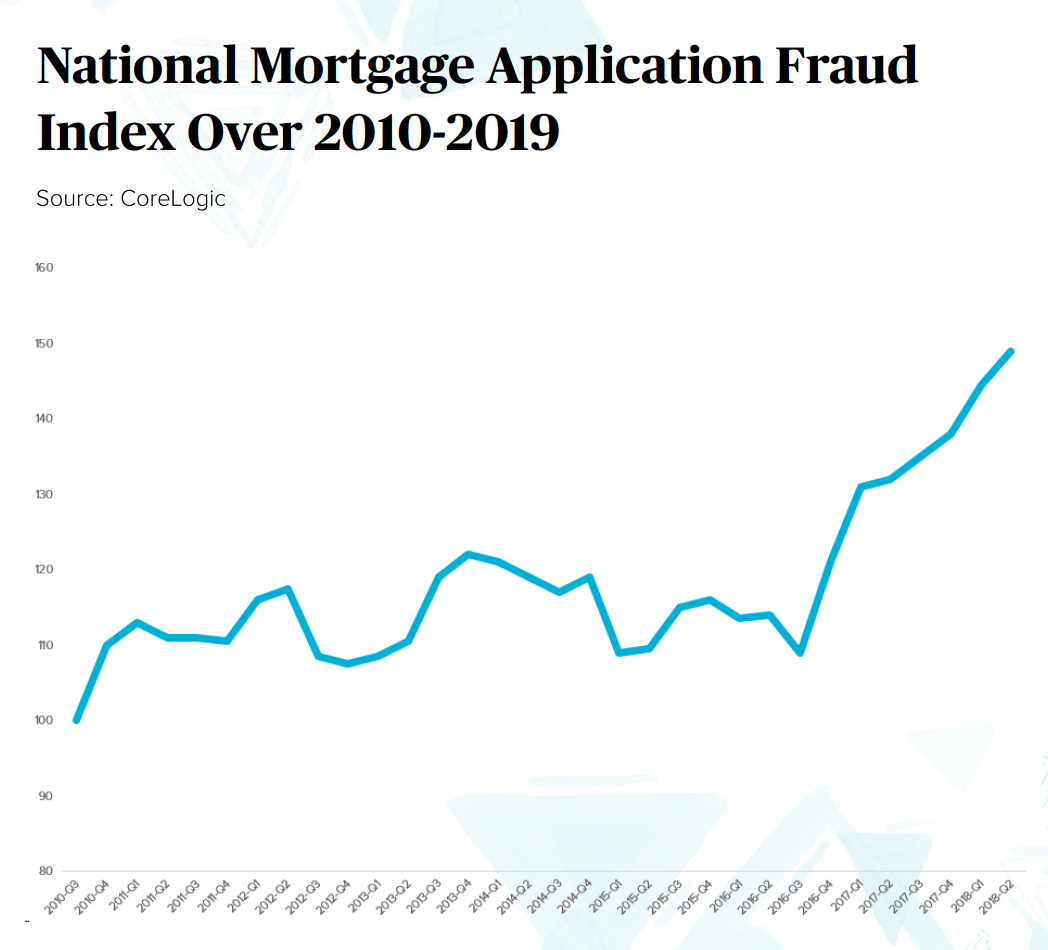

In 2018, mortgage fraud risk rose to its highest post-recession level, climbing 12.4% year over year in Q2 of 2018, according to CoreLogic’s annual Mortgage Fraud Risk Report which analyzes the collective level of fraud risk in the industry. Mortgage fraud is undeniably making a comeback, and lenders need to take measures now to protect themselves from the increasingly real threat of fraud.

In some ways, the mortgage market today can evoke a sense of déjà vu that harkens back to the market before the 2008 crash. Interest rates are on the rise; home prices are skyrocketing; affordability is down; new home sales have fallen 12% in the last year; and non-QM mortgages are making a comeback, sometimes barely disguised by their new moniker, ‘nonprime’ mortgages. It all feels eerily familiar.

Last time mortgage fraud crippled the industry, the fault for the rise of fraud largely fell in the laps of lenders. This time, our industry might be less in the wrong, but we still stand to get hurt the most in the process.

With independent lending on the rise and more than 52% of mortgages in 2018 originated by non-bank lenders, we are the most susceptible to damage when the industry softens.

Preventing fraud is difficult, but we have to do our part to avert the next financial disaster. Wire fraud alone is responsible for at least $5 billion in losses to consumers since 2013.

The economic impact of fraud is significant, and we must take real, proactive steps to protect our businesses (and clients) from falling prey to fraud. Detecting and preventing fraud is not an easy feat, but with thorough knowledge of popular fraud schemes and a proactive, defensive approach in your organization, you can prepare your team to weather the storm and make it through unscathed.

In our new eBook, “Mortgage Fraud, Past and Present,” you will learn more about the market dynamics that have caused a resurgence of mortgage fraud in the last several years. We will also trace the historical and economic roots that allowed mortgage fraud to thrive in the early 2000s, and discuss how mortgage fraud has evolved in the last decade since the subprime mortgage crisis.

Finally (and most importantly), we will share actionable tips and insights for lenders looking to implement fraud detection and prevention measures to protect their business from falling prey to mortgage fraud.

Get your complimentary copy of the eBook here.